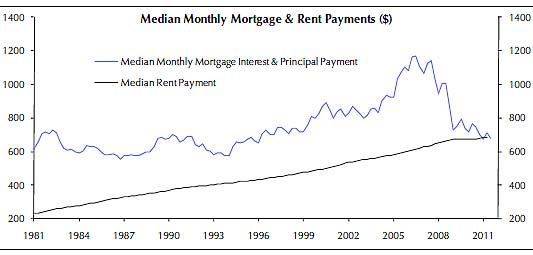

Wow. Over 30 years median rent has increased 300% (nominally) and the median mortgage payment has increased less than 20% (also nominally).

As Catherine Rampell says, this is a little bit misleading because down payments and maintenance costs have probably increased on par with rent, or perhaps even a bit more. Perhaps the mix of homes has changed a little, making medians less comparable.

But still. If you're investing for the long term, it's hard to see how buying a home wouldn't have a good return.

The fact that no one is buying suggests to me that we live in a fear-driven economy that is seriously detached from economic fundamentals. This is a bizarre, severely credit-constrained equilibrium or no equilibrium at all.

Update: Martin Feldstein has an interesting idea to keep home prices from falling further.

Subscribe to:

Post Comments (Atom)

Renewable energy not as costly as some think

The other day Marshall and Sol took on Bjorn Lomborg for ignoring the benefits of curbing greenhouse gas emissions. Indeed. But Bjorn, am...

-

The other day Marshall and Sol took on Bjorn Lomborg for ignoring the benefits of curbing greenhouse gas emissions. Indeed. But Bjorn, am...

-

The tragic earthquake in Haiti has had me wondering about U.S. Sugar policy. I should warn readers in advance that both Haiti and sugar pol...

-

A couple months ago the New York Times convened a conference " Food for Tomorrow: Farm Better. Eat Better. Feed the World ." ...

No comments:

Post a Comment