No time for thoughtful on-topic posts these days. Hopefully one sleepless night soon.

Here's a quickie on one of my favorite off-topic subjects:

Bill McBride at Calculated Risk reports that the national price-to-rent ratio is back to 1999 levels. That's well before the bubble took hold. For those who look only at this ratio as a guide to home prices, that's probably a sign that prices have reverted to fundamentals.

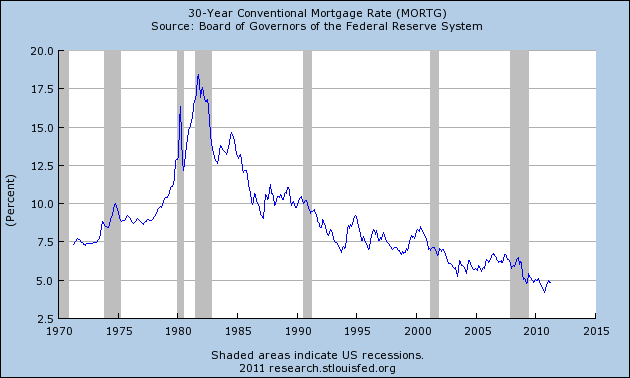

But consider today's interest rates compared to 1999:

Today we're looking at a 30 year mortgage rate that is about two-thirds the level in 1999.

I'd say that makes prices today look like a really good deal, especially given anecdotal evidence that rents are on the rise. When the economy does truly recover, those buying homes today will do very well.

Beneath national averages there is tremendous variation in price-to-rent ratios. In some areas home prices are much more attractive than others. That means home prices are a screaming deal in some places. Yet home prices are still falling.

I don't mean to give investment advice as much as point out how far off prices seem to be from fundamentals. I'd say our problems with debt deleveraging and irrational pessimism remain quite severe.

Subscribe to:

Post Comments (Atom)

Renewable energy not as costly as some think

The other day Marshall and Sol took on Bjorn Lomborg for ignoring the benefits of curbing greenhouse gas emissions. Indeed. But Bjorn, am...

-

The other day Marshall and Sol took on Bjorn Lomborg for ignoring the benefits of curbing greenhouse gas emissions. Indeed. But Bjorn, am...

-

The tragic earthquake in Haiti has had me wondering about U.S. Sugar policy. I should warn readers in advance that both Haiti and sugar pol...

-

A couple months ago the New York Times convened a conference " Food for Tomorrow: Farm Better. Eat Better. Feed the World ." ...

You'd have to consider also the idea of buying a house where the deals are best - I think people are avoiding these deals because the neighborhoods are essentially abandoned. Who'd want to live in a place like that?

ReplyDeleteJoel:

ReplyDeleteSome places with low price-to-rent ratios are quite nice. Others maybe less so.

But that doesn't matter so much given I'm looking at a ratio. Someone is living there are willing to pay a rent that exceeds current real interest rates by a large margin. That makes it a remarkable profit opportunity for anyone able to borrow at today's mortgage rates.